Last updated on February 12th, 2024

The next decade requires unprecedented leadership if we are to meet the challenges of the next #30Harvests and tackle climate change. Farmers and ranchers are among the most at risk to climate change but also steward the potential to cycle carbon and sequester it.

That’s why more than ever they’re using climate-smart practices to make their businesses and the planet more resilient. But bringing those solutions to scale requires far greater resources than we’ve deployed to date. That’s where transformative investment comes into the picture.

I am proud to announce the launch of a new USFRA report, “Transformative Investment in Climate-Smart Agriculture: Unlocking the potential of our soils to help the U.S. achieve a net-zero economy.” Together with our partners from The Mixing Bowl, Croatan Institute and the World Business Council for Sustainable Development, we set out the opportunity to work with the financial sector to co-create, co-innovate and bring much-needed investment to sustainable agriculture.

Investors are waking up to that possibility. ESG (Environmental, Social, Governance) funds are growing at $2 trillion per year. Yet, as we discovered in producing this report, agriculture is typically not part of these ESG portfolios. For example, in Q3 of 2020 alone, there was $10 billion in corporate support for green bond issuance and agriculture was not included at the table. That is a huge missed opportunity, with agriculture as a key sector that can contribute to positive impact.

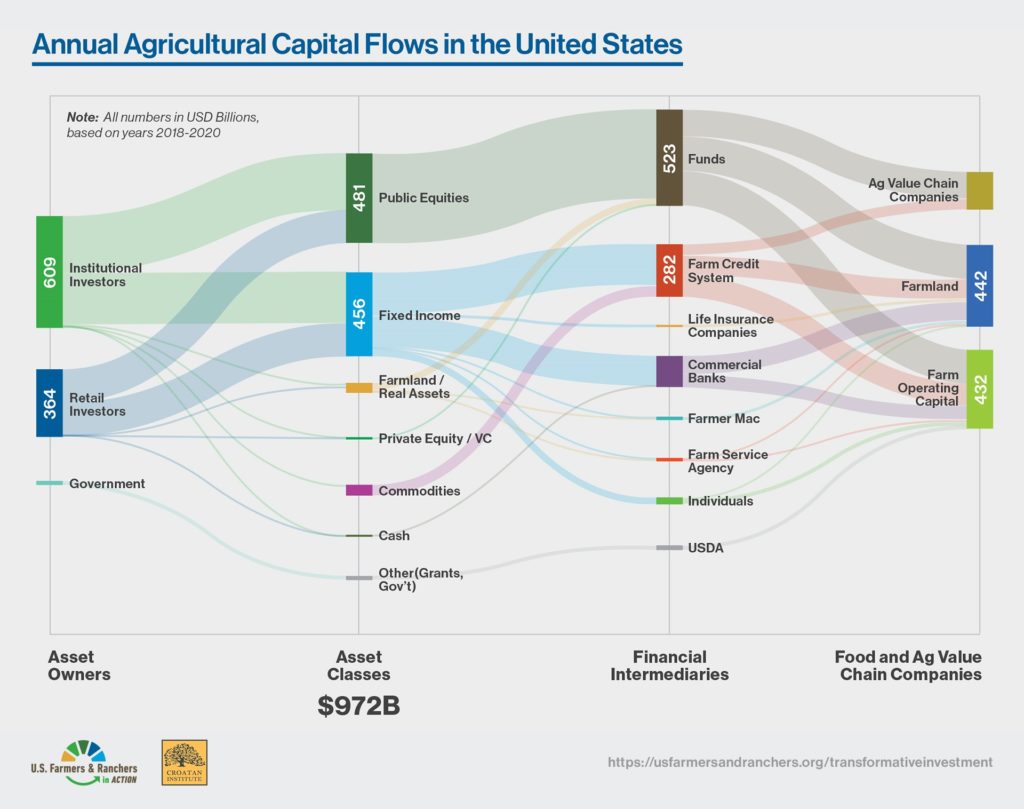

How big is that potential? There is some $972 billion flowing annually into the agriculture value chain. That was an eye-opener. We didn’t realize all the different ways that private sector investment is influencing and interacting with our farmers, but in order to achieve our goals we need to encourage transformative investment from the finance sector towards our shared goals. Innovative financial mechanisms like green bonds and community finance could help farmers and ranchers tap into that capital.

New forms of investment would allow agriculture to realize the vision of enabling a net-zero economy, and the promise of carbon drawdown, by scaling up climate-smart agriculture practices. Just as the renewable energy sector benefited from renewable energy credits and tradeable credits, and innovative fintech strategies, the ag sector could benefit from the same approach. And investors benefit from a more diversified ESG portfolio.

There are signs things are changing. We are excited that the U.S. SIF: The Forum for Sustainable and Responsible Investment, in 2020 for the first time named sustainable natural resources/agriculture as one of the top three specific areas of interest for money managers and institutional investors.

This is an encouraging sign. Agriculture has both the innovation and the people-based commitment and values to act on the UN Sustainable Development Goals for the next decade.

But we can’t do it without addressing the economic equation of the sustainability conversation.

This report is an initial examination of what will be a long-term effort to bring farmers and ranchers and the financial community into productive conversation that leads to real solutions.

As a call to action to leaders in the financial sector, we’d like to see them:

- Recognize that agriculture can be a solution to both society and the planet, on all levels of the Triple Bottom Line: social, environmental and economic.

- Get involved in the Decade of Agriculture, where the urgency of acting on climate change demands all hands on deck.

- Advance the financial innovation necessary to meet the broad needs of climate-smart agriculture

- Join farmers and ranchers on a journey to understand how agriculture can become part of their broad investment portfolio to enable a U.S. net-zero economy.

If we get this right, we could put the U.S. agriculture sector on the road to becoming the first net negative GHG emissions sector in the economy for our future. And that’s a huge win for everyone.

Erin Fitzgerald is the Chief Executive Officer at U.S. Farmers and Ranchers in Action.